The MLP Structure Is Under Siege

The MLP Structure Is Under Siege

Salary creating resources have made some trying memories since the Covid-19 pandemic started. Famous pay vehicles like ace constrained organizations (MLPs) have been particularly hard-hit. The dive in slotxo vitality costs adversely affected MLPs, in light of the fact that most of organizations organized as MLPs transport and store oil and flammable gas.

A Brief History of MLPs

The principal ace restricted organization (MLP) was shaped by Apache Oil Company in 1981. In 1987 Congress administered the principles for traded on an open market associations in Internal Revenue Code Section 7704.

A MLP issues units as opposed to offers, and passes benefits to unit holders as occasional disseminations. Generally, the huge favorable position for MLP financial specialists is that MLPs aren't charged at the corporate level. This course of action dodges the twofold tax assessment from corporate salary and profits influencing customary enterprises and their investors. Taking everything into account, this structure ought to convey more cash to unit holders.

MLPs gradually picked up in notoriety during the 1980s and 1990s, however during the 2000s the fame of the MLP model started to take off. In 2013, a record-breaking high of twenty new MLPs hit the IPO showcase, yet then oil costs smashed in 2014.

Midstream MLPs are commonly seen as cost gatherers for oil and gas makers that utilization their pipelines. Their incomes are secured by long haul, take-or-pay understandings. All things considered, their fortunes aren't as liable to the high points and low points of oil and gas costs. However, the oil value crash of 2014 was profound to the point that it at last hauled down MLPs also. That shook speculator certainty.

Until the oil value crash of 2014, MLPs had for quite some time been supported for their better than expected yields and stable returns. Many yielded 6%-8% and consistently developed those appropriations a seemingly endless amount of time after year.

Be that as it may, a resulting arrangement of occasions would additionally strain the MLP model.

Worries in the MLP Structure

In 2017, President Trump marked an assessment change charge that dropped the corporate personal duty rate from 35% to 21%. This is incredible for companies, yet it fundamentally decreased the key duty advantage a MLP held over an enterprise. This move made MLPs a less alluring alternative than they had been, on the grounds that there is extra multifaceted nature in charge petitioning for MLP financial specialists.

Second, a decision by the Federal Energy Regulatory Commission (FERC) to invert a longstanding arrangement on MLP charge costs for interstate pipelines drove up the expense of business for certain organizations. A few MLPs were altogether harmed by the FERC administering, again decreasing one of the points of interest they held over a practically identical company.

At long last, numerous MLPs pay motivator dispersion rights (IDRs) to their supporters. End of IDRs has been refered to as another motivator driving some MLPs to change over to partnerships, in light of the fact that these IDRs can be a delay development inevitably.

These variables joined to recoil the pool of MLPs the same number of changed over to organizations. That thus brought about institutional capital leaving MLPs, which has made net selling pressure on the area.

A large number of the remaining MLPs have freely talked about the chance of changing over. The market presently appears to support a corporate structure over the MLP structure.

A Case Study

The expanded MLP Brookfield Infrastructure Partners gives an informative model. Last September, this MLP declared that it was going to turn off another class of offers dependent on a corporate structure. The subtleties, from the official statement declaring the formation of the offers, clarified the inspiration:

The class An offers will be organized with the goal of being monetarily equal to units of BIP, including indistinguishable dispersions. The class An offers are planned to permit financial specialists the capacity to possess the proportionate monetary presentation to BIP, including indistinguishable dispersions, through a customary corporate structure.

The advantages of the making of BIPC will be:

Possible upgraded request from U.S. retail speculators because of progressively positive expense qualities,

Possible expanded interest from institutional speculators who are presently incapable, or favor not to, own organization units, and

The capacity to meet all requirements for additional record consideration, which isn't accessible today.

As a BIP unit-holder, this side project was quite compelling to me. Note that the explanation behind the side project is simply to make more interest for the offers over the MLP units, which are in any case indistinguishable inside and out.

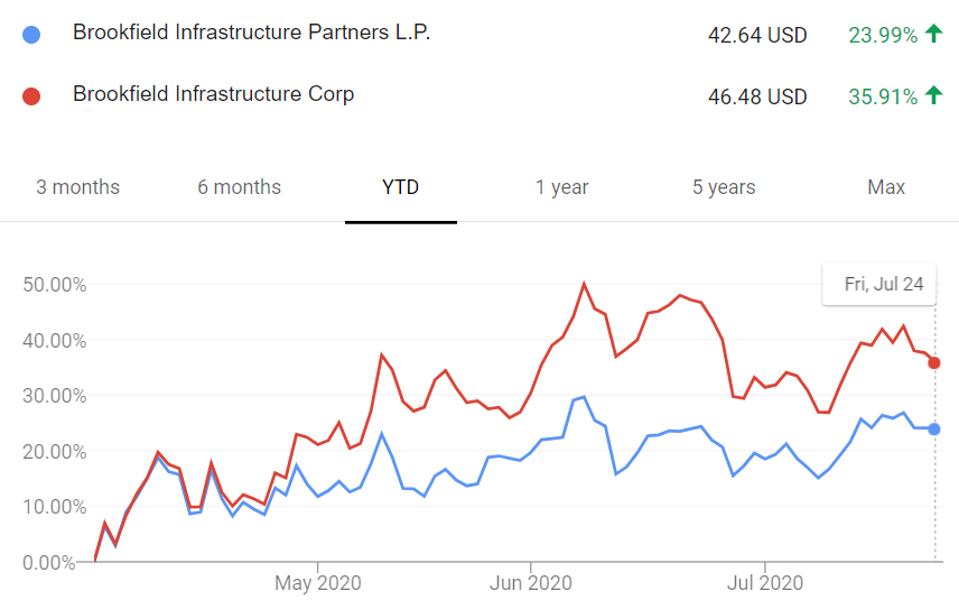

I watched with enthusiasm as my recently gave BIPC shares conveniently outflanked the BIP units. Truth be told, BIPC beat BIP about from the beginning

Remember that the organization hidden these two images is actually the equivalent. The main distinction is more popularity for shares over MLP units.

On the off chance that you hold a MLP, maybe the best thing that can happen is a transformation to an organization. Despite the fact that MLPs do at present have some assessment preferences over organizations, now the market is rebuffing the MLP structure. There is a convincing case to be made for changing over, on the grounds that it will open investor