Mall Operators As Retailers: Will REITailing Work?

Retailers used to be claimed by the person with slotxo his name over the front entryway: Macy's, John Wanamaker, Dayton and Hudson and all the more as of late Sam Walton's Walmart and Williams Sonoma.

As these retailing organizations became monster open concerns and possession regularly went to partnerships and financial specialists, they were all the while retailing organizations on a basic level, in it for the demonstration of offering things to individuals and not hypothesis dependent on different variables like land property.

Also, even as some retailing organizations were purchased by private value concerns and maybe the land the structure remained on was as basic as what was inside that building, it was as yet a retailing business most importantly.

In any case, presently we are seeing another wave in retail proprietorship, created in the course of recent years however exacerbated by the pandemic that has brought another player into the condition: land venture trusts — REITS — that own the shopping centers, malls and strip focuses where the retailers are found. It's a critical change in the business with results both great and terrible — and planned and unintended — for the American retailing industry.

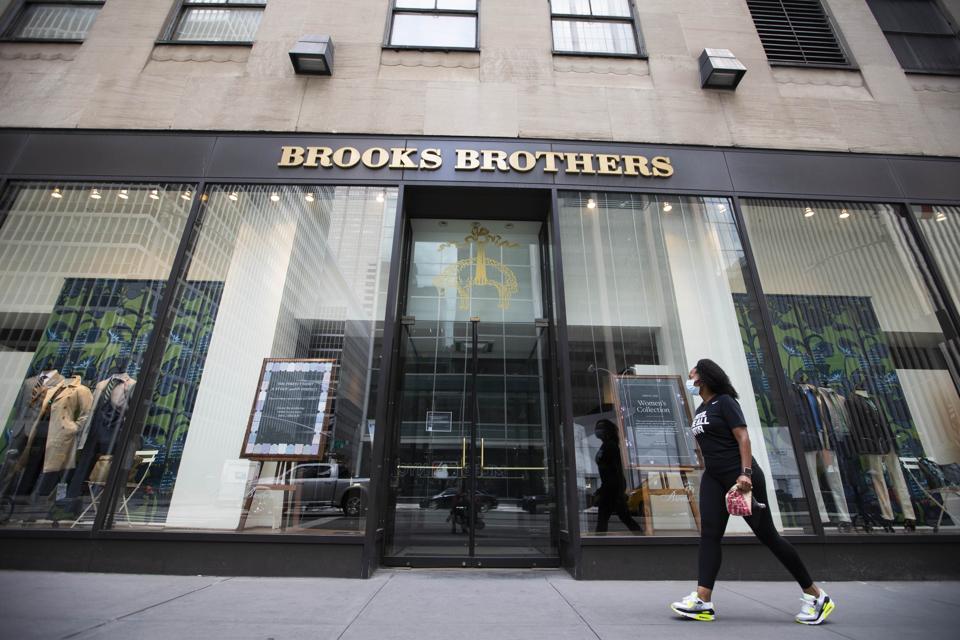

Perpetually 21 turned into the following obtaining. From that point forward the two, once in a while with an outsider that may deal with the genuine marketing some portion of the business, have been in bargains for such retailers as Brooks Brothers, Ascena (Ann Taylor, Loft, and so forth.) and now JCPenney. A portion of these arrangements will occur, some may not however the fact is that land proprietors have become players, not only landowners, in the retail business.

Obviously the advantages to them are self-evident. They get the chance to keep these stores as occupants, paying rent — to themselves it ought to be noted — instead of aggregating more empty customer facing facades in their properties. On account of stays like Penney, they keep littler occupants from dropping their leases because of arrangements dependent on inhabitance factors. What's more, they apparently show their help and long haul conviction for the matter of physical retailing.

On the drawback, for the shopping center administrators, is the likelihood that these are simply terrible ventures, purchasing up disturbed retailers who regardless of who claims them don't have the positions and methodologies set up to be effective. Would these shopping center administrators be in an ideal situation releasing these stores under and supplanting them with more feasible inhabitants, be they cafés, diversion scenes or even non-retail utilizes like office space or circulation focuses? That contention may have lost a portion of its facade given the social removing prerequisites achieved by the pandemic yet so too has physical retailing endured its shots from Covid.

The strip mall administrators additionally have their own issues. CBL Property Group, with more than 100 shopping centers in 26 states, as of late gave a "going concern" explanation in the midst of reports it may petition for financial protection and the administrators of the mammoth Mall of America (the still-covered American Dream in New Jersey) are accounted for to be behind in their installments on a $1.4 billion advance.

For the retail business it's a hodgepodge. Indeed, they get the opportunity to remain alive and out of the hands of private value proprietors who have demonstrated to be uniquely bad at running retail. However, they despite everything acquire a budgetary overlord whose interests lie in some different option from retail.

While the points of interest are to some degree extraordinary, this isn't the first run through land administrators have attempted to become retailers. During the 1990s Robert Campeau, a Canadian proprietor of land properties, got into the retail business first purchasing Federated Department Stores and afterward Macy's. Collecting a tremendous measure of obligation and not having much in the method of retail hacks, the entire thing was a calamity and he lost everything in insolvency. All the more as of late another retail bequest engineer, Richard Baker, has purchased up a string of inheritance retail organizations including Saks Fifth Avenue and Hudson's Bay Co. be that as it may, a large number of his other retail ventures have gone bad and not long ago he took the organization private trying to turn it around. It is not yet clear if that procedure will work or whether Baker will join the rundown of bombed retailers to come out of the land division.

The current REITailing development is still too new to even think about judging. History would propose it will make some intense memories succeeding. Be that as it may, history nowadays might be a helpless pointer of what will occur and what won't as we enter an extremely unchartered area.

In any case, odds are we'll know soon enough if getting genuine is a smart thought for the retailing industry.